What Happens When Inheritances are Unequal?

Robert, the older brother, and Lon, the younger one, were close as they were growing up in the Queens borough of New York City. However, when their mother passed away and left the bulk of her estate to Robert, Lon was devastated.

Estate Planning for Different Ages and Stages of Life

An estate plan works like the operating system on your phone or computer. It runs in the background. However, it needs occasional updates to keep the plan current.

What Is a Living Will?

The financial consequences of a diagnosis of Alzheimer’s disease or any one of the rarer dementias can easily fall to the family of the patient. In any diagnosis that includes declining mental health, it’s important to get one’s financial house in order.

Factors to Consider when Picking Executor, Trustees and POAs

One of the biggest challenges that clients encounter during the process is deciding who to appoint as their trustees, powers of attorney, health care surrogates and executors.

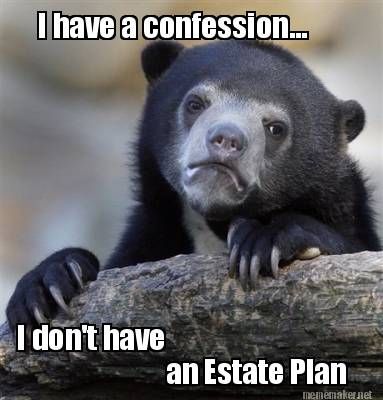

Why Don’t Most American have an Estate Plan?

Just 34% of adult Americans have an estate plan and 37% of respondents said they didn’t have a plan at the ready.

How Does an Irrevocable Life Insurance Trust Work?

Life insurance is often a cornerstone of a comprehensive estate plan, particularly when an estate consists of largely illiquid assets.

Estate Planning Considerations for Minor Children

When preparing estate planning documents, certain beneficiaries may need more protection than others. One particular class of beneficiaries that needs to be intentionally considered is minor children.

How Important Is a Health Care Power of Attorney?

It is your right to keep your health information private, but is that always what is in your best interests?

What Is a Living Will?

An element of advance care planning, a living will is a legal document that provides specific instructions on how to carry out your wishes to receive or decline such treatments when you otherwise can’t communicate those wishes yourself.

Important Documents in Your Estate Plan

There are two documents everyone needs in their estate plan: The Durable Power of Attorney (DPOA) and a Health Surrogacy or Advanced Health Directive.