Three Key Steps for Estate Planning When You Don’t Have Children

It gets a lot more complicated if you can’t count on a child to be a caregiver, or to make major decisions.

It gets a lot more complicated if you can’t count on a child to be a caregiver, or to make major decisions.

You’ve worked hard for your wealth. Don’t let it fall into the wrong hands. Consider prenups, trusts and other protections to safeguard your family legacy.

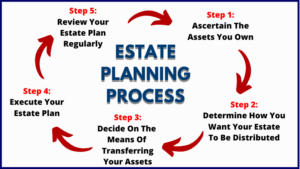

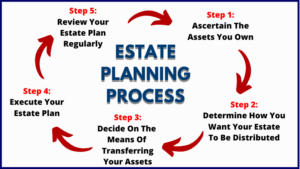

Estate planning is crucial and beneficial in many ways since it documents all your assets—from real estate, bank accounts, investments and business interests to personal items, like family heirlooms and even your monthly subscriptions.

Learn how trusts can protect your heirs’ inheritance from creditors and safeguard your family’s financial future.

Protect your child’s future by creating a trust that supports their recovery, while safeguarding their inheritance.

While most Americans aren’t in the market for tax shelters, the allegations in this case are a reminder of what can happen when taxpayers ignore professional advice and common sense on taxes.

Relationships with significant age gaps come with unique rewards and challenges, especially for couples discussing how to manage their estate later in life.

The death of a spouse leaves a long list of things to do, all while you’re grieving. It can be tough to know exactly what to tackle first.

A revocable trust allows assets correctly transferred into the trust during the grantor’s lifetime to bypass probate. This can simplify asset distribution and help preserve privacy.

Here are some common solutions for planning related to estate, gift, and generation-skipping transfer tax, major liquidity events, state income taxation, and estate planning for single individuals.