Probate: What Is it? How Does it Work?

In certain instances, particularly when there is no Will, the system ensures that all accounts and property are distributed in accordance with state law.

In certain instances, particularly when there is no Will, the system ensures that all accounts and property are distributed in accordance with state law.

While more than half of Americans believe estate planning is essential, a mere 33% actually have a living trust or will. And one out of three respondents who don’t have a will reason that they don’t think they have sufficient assets to warrant estate planning.

There are frequently asked questions that people have about revocable living trusts, wills, supported decision making agreements (new), powers of attorney and advance health care directives.

A badly in debt woman dies leaving the proceeds of substantial insurance policies to her children only to have her trust contested by relatives who claim an amendment naming the children as beneficiaries is invalid with no witnesses, misspelled names, suspicious signatures and was never given to previous trustees for review as required by agreement. A long, expensive, and protracted legal battle likely is brewing.

When you’re in the midst of a divorce, you’re probably not thinking about estate planning or your will. However, if you’re divorcing, you should think about the impact a divorce can have on an estate plan.

The first step in understanding whether a power of attorney can transfer money to themselves is to understand the different types of power of attorney.

As the calendar turned to 2023, many of us took a moment to think about resolutions. I want to lose 10 pounds. I want to read things that aren’t just about work. I want to learn how to play pickleball. Or maybe this year I’ll give a relationship another shot. Maybe I’ll even remarry.

The SECURE 2.0 Act, which was signed into law in December 2022, changes the RMD rules for retirement savers beginning in 2023.

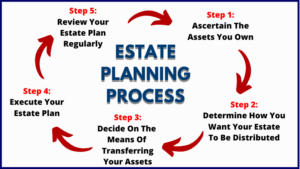

It is a common misconception that once the estate plan is prepared and executed, it does not require any further attention.

Estate planning isn’t just for the ultra-wealthy, nor is it something you should put off until your golden years.