Which Trust, Revocable or Irrevocable?

There are important differences between the two types of trusts, including the amount of control you’ll have over your assets.

There are important differences between the two types of trusts, including the amount of control you’ll have over your assets.

A document usually included in an estate planning package is a financial power of attorney. What is a financial power of attorney?

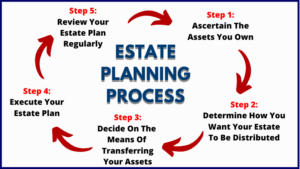

Whether planning as the predecessor or the next generation, having the right processes — and partners — in place will set up the transition for success.

Have you found an executor (also known as a personal representative) to handle your affairs should you become incapacitated or die?

The distribution of wealth among beneficiaries through your final will and testament is often a complex and sensitive issue, one that can potentially spark conflicts and legal challenges among family members.

We have a situation where both of my in-laws passed away in the last several years. My wife was the daughter and she and her brother are the executors to the last of my in-laws to pass away.

Before the original SECURE Act, IRA owners who died were able to leave their accounts to their children, grandkids, or other non-spouse individual beneficiaries, and heirs could stretch required minimum distributions (RMDs) over their own lifetimes, thus allowing the funds in the accounts to grow tax-free for decades.

The person you have placed in charge of your estate under a Will is called a ‘Personal Representative’ or ‘Executor/Executrix.’

One of the most common misconceptions about a last will and testament is that having a will avoids the need for probate court.

Many people will suffer cognitive decline as they age, and that can seriously impact their ability to manage their assets.