Three Top Excuses Heard by Estate Planning Attorneys

We all know we’re going to die one day. There are things we should put in order before that time comes.

We all know we’re going to die one day. There are things we should put in order before that time comes.

Blended families face a higher risk of estate conflicts—clear documents, open communication and thoughtful planning help protect relationships and prevent legal battles.

Managing a special needs trust requires more than good intentions—legal compliance, financial knowledge and long-term commitment often make a professional trustee the right choice.

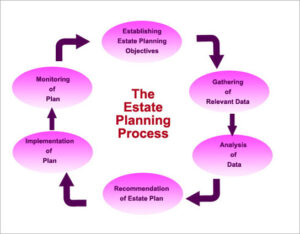

Estate planning is crucial for protecting family wealth and ensuring financial security.

You don’t need a hefty bank balance or massive estate in order to need a will and estate plan.

An RLT, like any trust, is a method of holding property where the ‘legal’ aspect of ownership is separated from its ‘beneficial.’

An estate plan is only effective if the right people know where to find essential documents when they are needed.

Learn the pros and cons of using revocable trusts to protect your assets and your privacy, and how they differ from wills.

Inheriting a home comes with financial, legal, and emotional responsibilities—understanding your options can help you make informed decisions.

March is Developmental Disabilities Awareness Month. It’s the right time to learn how special needs planning improves the lives of those with disabilities.