Wealth Protection Through Estate Planning. Without a well-prepared estate plan, wealth can be lost to taxes, administrative costs, or disputes among heirs, both in and out of court. With an up-to-date estate plan, changes to tax laws are proactively addressed and wealth can be protected and passed across generations. A recent article appearing in Medical Economics, “Estate planning is your first line of defense against wealth loss—Here’s what you should know,” explains how an estate plan creates a framework to minimize taxes, avoid the costs and complications of probate and ensures that your wishes for your estate are followed.

Wealth Protection Through Estate Planning: Documenting assets is one task that is done when creating an estate plan. When records are not clear, transferring assets can become complicated. A comprehensive record-keeping system can store documents like deeds, life insurance policies, asset inventories, family videos and photographs online.

Many financial records are already online through client portals by major financial companies. The key to incorporating these records into an estate plan is remembering where all the information is stored and being willing to share access information with a trusted family member or friend. The person you name as an executor of your will or a trustee for a trust is the most likely candidate to be provided with this information.

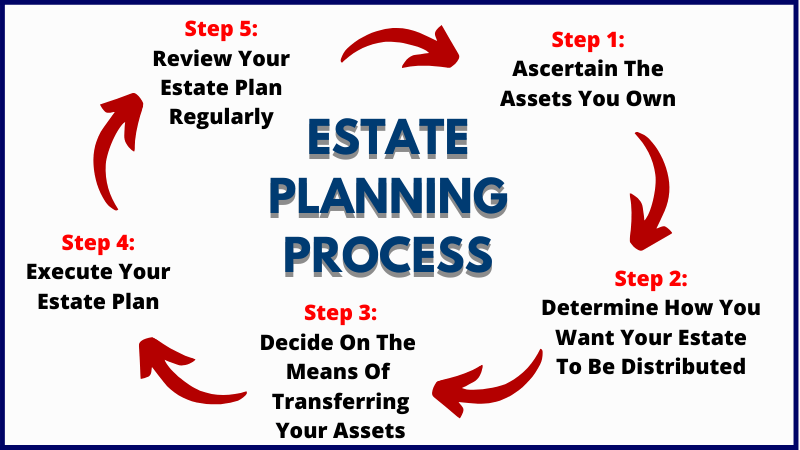

There are many steps to having a solid estate plan. However, there are also many missteps. Here are some of the most common pitfalls to avoid when trying to accomplish Wealth Protection Through Estate Planning:

Failing to update an estate plan. All the documents in your estate plan, including a Will, Power of Attorney, Healthcare Proxy, HIPAA Release Form, Trusts, Advanced Directives and more, must be updated to comply with changing laws and changes in your life.

Making a careless decision about the executor or trustee can be disastrous. The eldest child does not have to be the one to be in charge of your estate. Neither does the person you love if their life is a trainwreck. The person to be named executor and/or trustee needs to be someone you know to be extremely responsible, reliable, good with money management and a solid moral compass.

Digital assets are often ignored when it comes to estate planning. However, this new asset class needs to be included. If you have email, you have a digital asset. You have digital assets if you have email, cryptocurrency, websites, social media content, online subscriptions and photos stored in the cloud. Suppose no plan is made to create an inventory of accounts and name a digital executor. In that case, your estate becomes vulnerable to identity theft, valuable cryptocurrency could be lost forever and there may be nothing your loved ones can do.

Most family fights have to do with unequal asset distribution after the death of a parent. A clear estate plan is one way to preclude confusion about what you want to happen after death. Talking about your estate plan while you’re still able to have these uncomfortable discussions is one way to help establish your wishes. You may want to create a Letter of Intent or make a video to express your reasons for making certain decisions. This may not be legally enforceable. However, it will serve to document your wishes.

Estate planning is not just about distributing assets after death. By establishing an estate plan, the family is better prepared to deal with the loss of a loved one and can focus on healing together instead of battling over their inheritance.

Reference: Medical Economics (Oct. 17, 2024) “Estate planning is your first line of defense against wealth loss—Here’s what you should know”